Table of Content

NO MATTER WHAT, i will ONLY do business with Greg at North Point. I have been to 3 other jacobsen dealers and this is the one. For the same home i am interested in, in middleburg fl., i was quoted almost twice what it sells for AND i drove more than an hour, each way, to hear that. I was also told they had the models i was interested in AND they were NOT on the lot..... Your length of service or service commitment, duty status and character of service determine your eligibility for specific home loan benefits. A. The 'Start Application Process' button will take you to the log-in page.

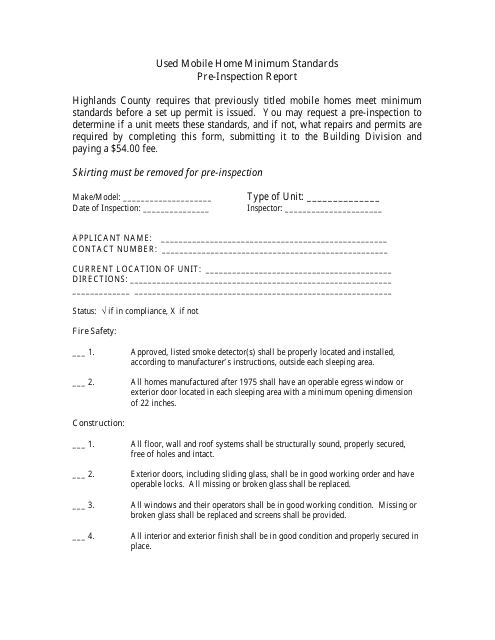

The Veterans Administration however does not require an engineer report to inspect tie downs. The cost of retrofitting can range anywhere from $1,200 to $3,000, I’ve seen a pretty wide range of quotes depending on the size of the manufactured home. Its important to remember that an escrow hold back is not allowed for the cost of retrofitting the property. If the property has changed hands since 1994 and the purchaser used a government backed loan then it should have been retrofitted to current standards. Additionally the engineer will inspect the siding around the bottom of the home making sure that there are no holes larger than an inch. Preparing for this inspection beforehand is always smart because a hole in the siding is easily remedied with spray foam.

FLORIDA

This could not be accomplished by adding thousands of dollars to your new FL mortgage to pay commissions to a mortgage broker. In some cases we can finance single wide manufactured homes. You must have good credit and the loan amount can’t be too small (approximately $150,000 or more). First thing is first, technically a mobile home is a factory built home that was constructed prior to June 15, 1976. Even so people still today call newer manufactured homes mobile homes. The terms people use can change depending where you live but in Florida people often use the term mobile home for manufactured homes constructed after 1976.

VA allows a seller such as Florida Modular Homes to pay for all the borrowers closing cost as well. Florida Modular Homes appreciates all that our Veterans have done for us and will donate $200 toward the Wounded Warrior Project for every veteran who purchases a home from us. Most people will require some sort of financing when they are purchasing a new home. With this in mind, Florida Modular Homes has teamed up with a handful of lenders who understand our product, market, and most importantly our customers. The team at Florida Modular Homes are experts in financing and in many cases can get individuals financed that may have been previously turned down. We don't offer any loan products with a balloon payment at the end of the term.

Q. How does Easy Mobile Homes protect my personal information?

Located on a double corner lot at Hwy 20, less than 20 minutes to Destin Beach and Santa Rosa Beach areas. We will respond promptly to any questions you may have about any loan program or getting pre-approved. Please note that due to lending restrictions and secondary market appetite its very difficult to finance a manufactured home under $80,000. Structural foundation certification not required unless the appraiser notes issues or requires such a certification. We can not finance a manufactured home as an investment property. A manufactured home is a factory built home constructed to the HUD Title 6 construction standards that took effect after June 15 of 1976.

Older model mobile homes needed to have at least 320 square feet of livable space. But now, that space requirement is at least 400 square feet for modern mobile homes. This can make it easier to set your monthly budget, and can also provide peace of mind. With a fixed-rate loan, even if market interest rates go up, your principal and interest payments won’t. For Buyers - We have several financing options available that include, VA, FHA, Conventional and Seller type Financing.

FINANCING PROGRAM

USDA Rural Development’s Single Family Housing Guaranteed Loan Program has options for lenders to help homebuyers finance homes across rural America. This includes manufactured homes, which can help boost the housing supply in rural America and bring homeownership within reach for millions of people. E are able to offer the lowest Florida manufactured home loan rates possible along with a Variety of Florida Manufactured Home Loan Programs to meet the needs of a Nation. Indian Reservations in FL are unique as the true ownership of the land is the Tribe, similar to a Co-Op park. As the tribe grants you land, they retain the ultimate ownership of that land and access to the reservation. In the past, we have made FL financing loans in reservations with the agreement of the tribal counsel that we could enter the reservation and/or property in the event of default.

Once you find your dream home in Florida, you have multiple financing options available to you. When you are financing the land as well as the home itself, you’re likely to use a conventional land or land construction loan. If you’re financing just the home itself, you’ll probably use a chattel loan. Check out the listings below to find a lender in Florida that can help you find the right manufactured home loan. Once your Florida Mobile Home loan is Approved, the amount of the Down payment determines the Interest Rate offered.

As an example, a 10 or 20 Percent Down will offer a Better Rate than 5 Percent Down. Our terms vary from 7 years to 25 years, depending on the program you choose. The bestFlorida manufactured home financing rate can be obtained in most cases at a 15 year term. You can apply for a P2P or personal loan to get a transportable mobile home. However, you may need at least a 5% down payment and pay higher interest rates.

If it is a manufactured home built to HUD code there will be two forms of verification, a certification label and a data plate. The data plate will be located somewhere inside the home, often near an electrical box, the main thing is it has to be easily visible. You can find the certification label on the tail end of each transportable section of the manufactured home. Just fill out the form below and one of our financing experts will be in touch as soon as possible. Transported directly from the manufacturer to the site where it will be financed.

The warm climate and retirement benefits have sparked many manufactured home communities in Florida to offer affordable and comfortable options. MH Loans has been servicing the mobile home market for 20 years and this experience continues to benefit clients. Connect today to learn how you can receive the guidance you need. Propertythat is not on a paved road may require a larger down payment or lower loan-to-value.

Your down payment can be as low as 3.5% of the purchase price. Florida Modular Homes can also pay for all or most of the buyer’s closing cost as well, which allows our customers to keep more of their money in their pocket. Of all the government insured loans available, FHA is usually the easiest with credit qualifying. JCF Lending Group has no specific foundation requirements in FL. As previously mentioned, the home must be set-up and in move-in condition, to include functioning electrical and plumbing.

These homes are titled through FL Department of Motor Vehicles, and all escrow and/or closing functions will be handled by us, not a 3rd party escrow company, as in real estate transactions. The manufacturedor mobile homes that we can finance in Florida are considered personal property, not real property and/or real estate. These homes are titled through Florida Department of Motor Vehicles, and all escrow and/or closing functions will be handled by us, not a 3rd party escrow company, as in real estate transactions. JCF Lending Group offers Used Florida Manufactured Home Financing. We are a home only lender, providing Florida manufactured home financing for homes not attached to real property by way of deed or title. We do not finance manufactured homes and land, just the Florida manufactured home.

You have 60 days from the start of the application to complete it. Loan Amount– minimum loan amount is $22,000 for person-to-person lending and $14,000 if you are purchasing from a retailer. If you are in the market to buy your new home or in the market to sell your current home, we have the experience and all the tools to successfully bring home Buyers and home Sellers together. 368 Windflower St. Defuniak Springs, FL.- Spacious 3 bedroom 2 baths. Big family room with a cozy fire place and a rocking chair front porch. Recently renovated with updated kitchen, new appliances, new floor covering and fresh paint.

No comments:

Post a Comment